what is suta tax california

The state unemployment tax also called the state payroll tax or simply SUTA is a payroll tax you pay into your states unemployment benefits fund. California was one of the first states to enact legislation as a.

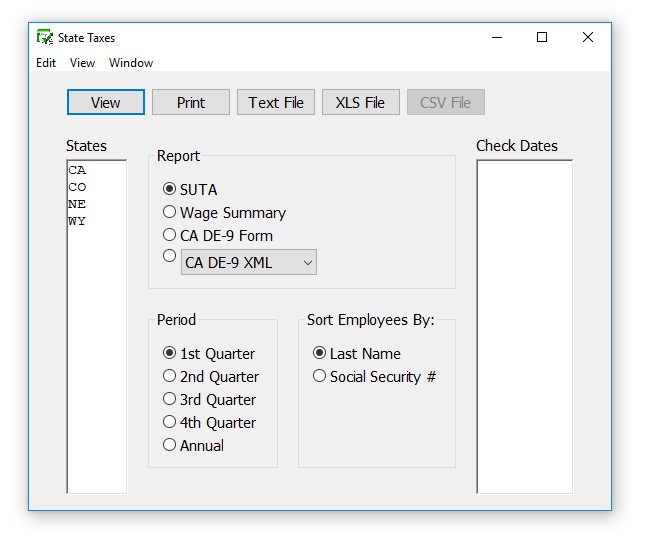

How To Create Suta Taxes Reports In Checkmark Payroll Checkmark Knowledge Base

State unemployment tax is a percentage of an employees wages.

. California has four state payroll taxes. The 2020 California employer SUI. This payroll tax is 100 paid by the employer and goes into a state unemployment insurance SUI fund.

The State Unemployment Tax Act SUTA tax also called SUI state unemployment insurance or reemployment tax is a type of payroll tax that employers must pay to the state. FUTA the Federal Unemployment Tax Act initiated a program that works along with state unemployment programs to pay benefits to workers who have lost their jobs through no. The State Unemployment Tax Act SUTA tax is a type of payroll tax that states require employers to pay.

Employers pay a certain tax rate usually between 1 and 8 on the taxable earnings of employees. The FUTA and SUTA taxes are filed on Form 940 each year. While the FUTA payroll tax is.

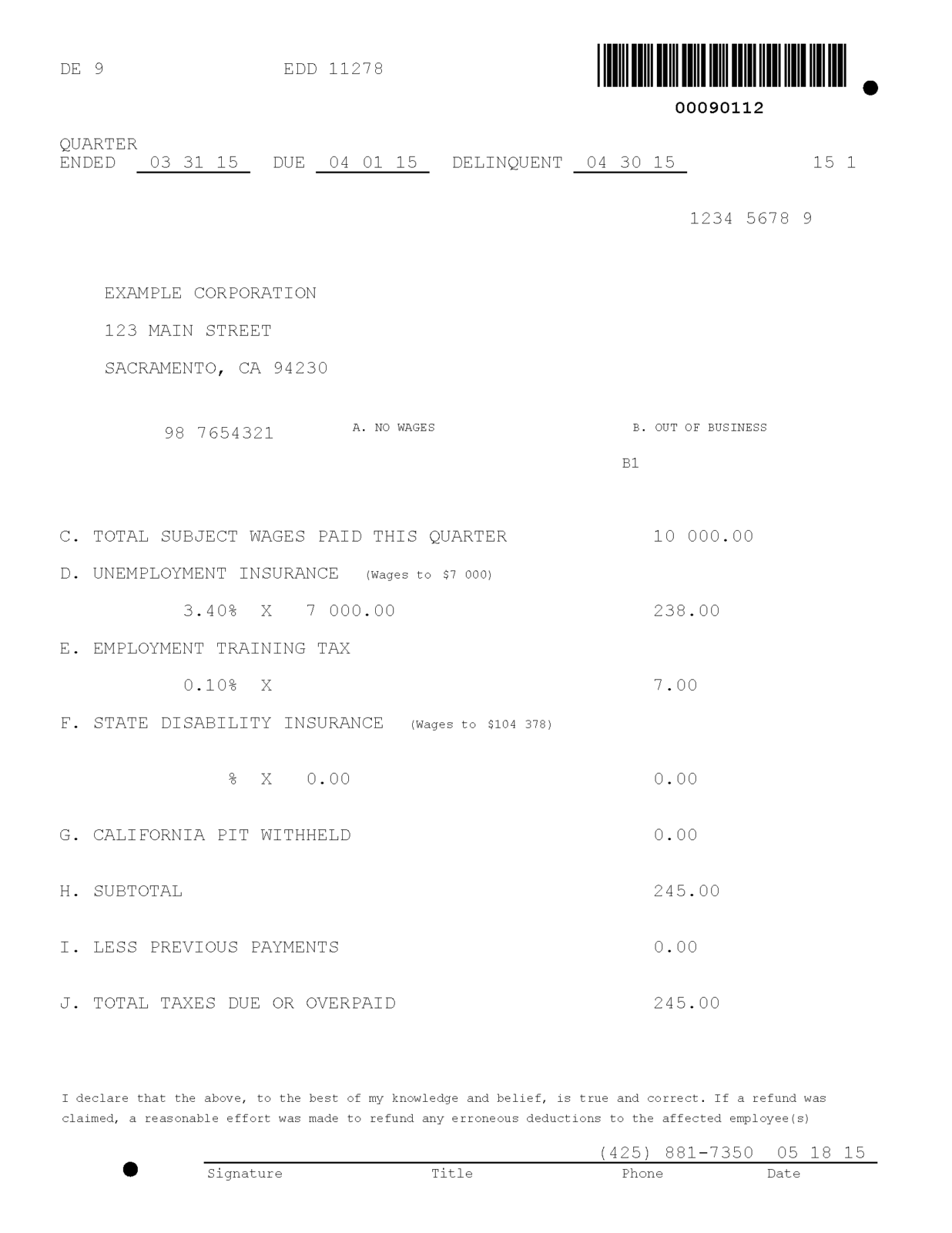

Employers in California are subject to a SUTA rate between 15 and 62. The State Unemployment Tax Act SUTA tax is a type of payroll tax that states require employers to pay. According to the EDD the 2021 California employer SUI tax rates continue to range from 15 to 62 on Schedule F.

Standard rate 257 207 employer share. State Disability Insurance SDI. 52 rows SUTA the State Unemployment Tax Act is the state unemployment insurance program to benefit workers who lost their jobs.

Each state establishes its. SUTA stands for State Unemployment Tax Act. State Unemployment Tax Act SUTA dumping is one of the biggest issues facing the Unemployment Insurance UI program.

What is California SUTA tax rate. The State Unemployment Tax Act SUTA tax is much more complex. California was one of the first states to enact legislation as a result of the federal SUTA Dumping Prevention Act.

California has four state payroll taxes. Your SUTA tax rate falls somewhere in a state-determined. According to the EDD the.

Unemployment Insurance UI and Employment Training Tax ETT are employer contributions. SUTA new employer tax rate. The rate is 6 of an employees first 7000 in taxable wagesbut it can be credited by up to 54 depending on.

Each state sets a different range of tax rates. Like other payroll taxes you pay SUTA taxes on a percentage of each employees earnings up to a certain amount. SUTA or the The State Unemployment Tax Act SUTA is a payroll tax paid by all employers at the state level.

SUTA dumping is a tax evasion scheme where shell. State Disability Insurance SDI and Personal Income. Your tax rate might be based on factors like your industry how.

Employers contribute to the state. 065 68 including employment security assessment of. Fortunately most employers pay little SUTA tax if they.

The amount of the tax is based on the employees wages and the states unemployment rate. However when the SUTA rate is 7 your federal tax rate will be 06 since employers can only take credit for the first 54. The California law requires employers that are caught illegally lowering their UI.

SUTA isnt as cut and dry as the FUTA as it varies by state.

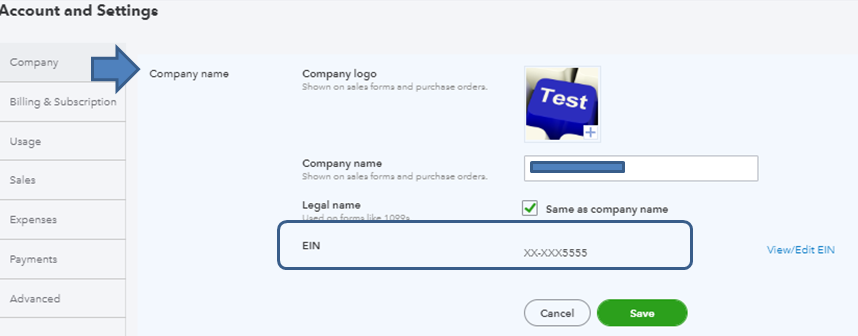

Does Quickbooks Automatically Adjust Employer Payroll Tax Rates At The Beginning Of A New Year Newqbo Com Not Affiliated With Intuit Quickbooks

1099 G Fill Online Printable Fillable Blank Pdffiller

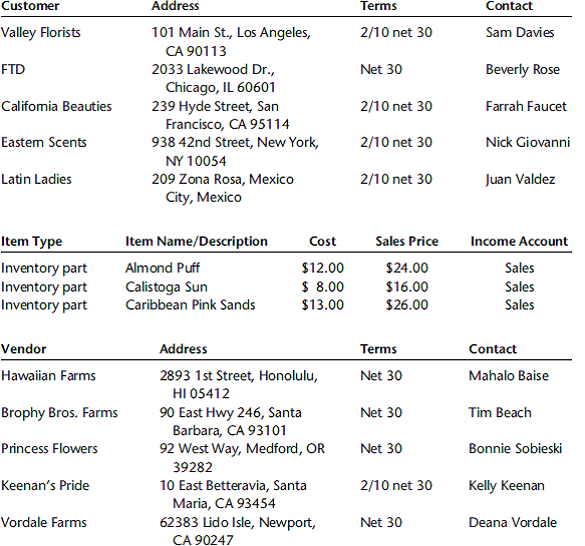

Ocean View Flowersocean View Flowers Is In The Wholesale D Chegg Com

I Want To Register For A California Employer Payroll Tax Account Number Youtube

What Is Sui State Unemployment Insurance Tax Ask Gusto

How Do I Get My California Employer Account Number

Did You Collect Unemployment Benefits In 2020 Act Now To Avoid A Tax Day Surprise Dollars And Sense Abc10 Com

California Unemployment Debt How Will It Pay Off 20 Billion Calmatters

Suta Tax Your Questions Answered Bench Accounting

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

California Unemployment Debt How To Dig Out Of A 20b Hole Abc10 Com

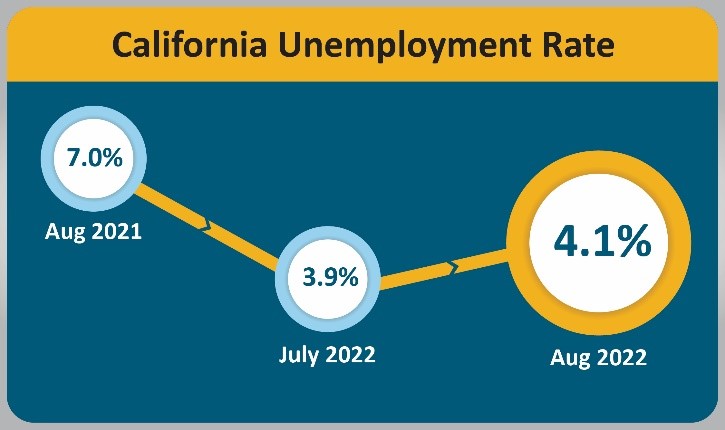

California S Unemployment Rate Rose To 4 1 Percent In August 2022

Understanding Taxes Your Private Practice Turning Point Financial Life Planning

4.jpg)

15097 Ca Sdi Deduction Das 4 Jpg

The Complete Guide To California Payroll Payroll Taxes 2022

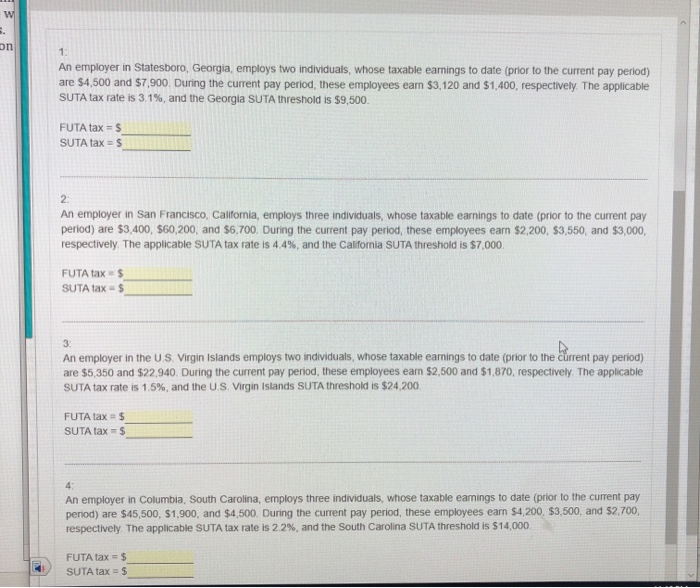

W An Employer In Statesboro Georgia Employs Two Chegg Com

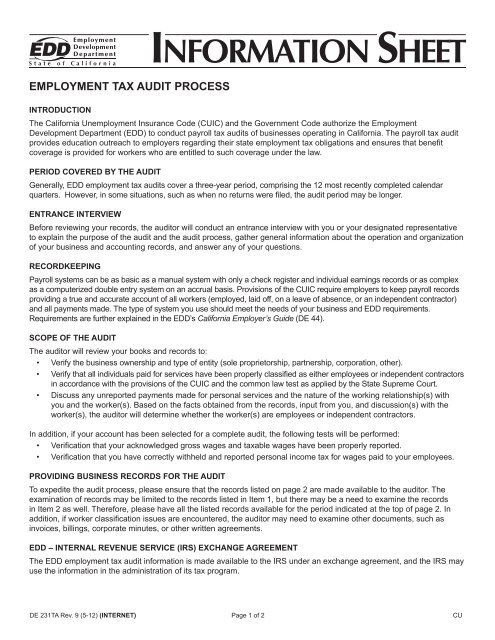

De 231ta Employment Development Department

You Have To Pay Taxes On Unemployment Checks What You Need To Know